Featured

Table of Contents

The catch is that nonprofit Credit score Card Financial obligation Forgiveness isn't for everybody. InCharge Financial obligation Solutions is one of them.

The Credit Card Mercy Program is for individuals that are so far behind on credit report card repayments that they are in severe financial difficulty, possibly facing bankruptcy, and do not have the revenue to catch up."The program is specifically designed to aid customers whose accounts have been charged off," Mostafa Imakhchachen, customer treatment professional at InCharge Financial debt Solutions, stated.

Lenders that take part have actually agreed with the not-for-profit debt counseling firm to accept 50%-60% of what is owed in taken care of monthly repayments over 36 months. The fixed settlements mean you know specifically just how much you'll pay over the repayment duration. No passion is charged on the equilibriums throughout the payback period, so the settlements and amount owed do not alter.

Yet it does show you're taking an energetic role in minimizing your financial debt. Considering that your account was already method behind and billed off, your credit rating was already taking a hit. After negotiation, the account will certainly be reported as paid with an absolutely no equilibrium, instead than superior with a collections business.

About Questions to Ask Any Bankruptcy Counseling Provider

The agency will certainly pull a debt record to comprehend what you owe and the extent of your difficulty. If the forgiveness program is the best service, the therapist will certainly send you an arrangement that information the plan, including the amount of the monthly settlement.

When everybody agrees, you begin making month-to-month payments on a 36-month strategy. When it mores than, the agreed-to amount is removed. There's no fine for paying off the equilibrium early, but no expansions are permitted. If you miss out on a payment, the contract is squashed, and you have to leave the program. If you think it's an excellent alternative for you, call a therapist at a not-for-profit credit history therapy company like InCharge Financial debt Solutions, who can address your inquiries and help you establish if you certify.

Due to the fact that the program enables debtors to opt for less than what they owe, the financial institutions who take part want reassurance that those that make the most of it would not have the ability to pay the total. Your credit score card accounts additionally must be from banks and debt card firms that have actually concurred to participate.

The Of Economic Uncertainty and How More Americans Need for Professional Help

If you miss out on a settlement that's simply one missed out on payment the contract is terminated. Your financial institution(s) will certainly terminate the plan and your balance goes back to the initial quantity, minus what you've paid while in the program.

With the mercy program, the lender can instead pick to maintain your debt on the books and recover 50%-60% of what they are owed. Nonprofit Debt Card Financial debt Forgiveness and for-profit debt negotiation are comparable because they both give a means to settle charge card debt by paying less than what is owed.

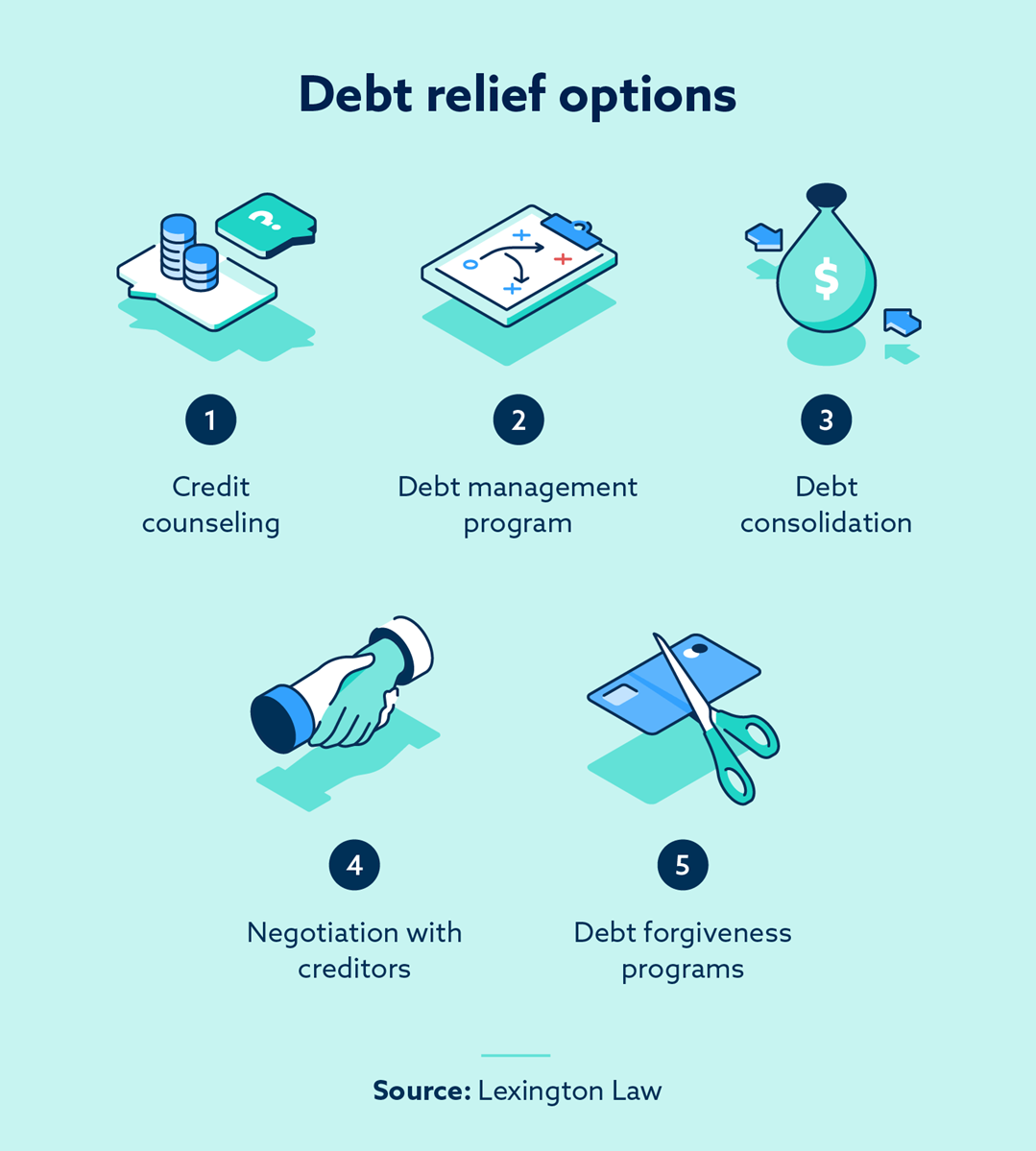

Bank card mercy is developed to set you back the consumer less, repay the financial debt quicker, and have fewer downsides than its for-profit counterpart. Some crucial locations of difference between Charge card Debt Forgiveness and for-profit financial debt settlement are: Charge card Debt Forgiveness programs have connections with lenders who have concurred to take part.

The 25-Second Trick For A Guide to Specialty Counseling Services : APFSC Tailored Financial Support and Your Rights

Once they do, the benefit duration starts immediately. For-profit debt negotiation programs discuss with each lender, normally over a 2-3-year duration, while passion, fees and calls from financial debt collectors continue. This implies a bigger hit on your credit rating record and credit history, and an increasing equilibrium up until arrangement is completed.

Charge Card Debt Mercy customers make 36 equivalent monthly repayments to eliminate their financial obligation. The settlements go to the creditors till the agreed-to balance is eliminated. No interest is billed throughout that period. For-profit financial obligation negotiation customers pay right into an escrow account over a negotiation period towards a round figure that will certainly be paid to financial institutions.

Table of Contents

Latest Posts

9 Easy Facts About Exploring Debt Forgiveness in Uncertain Times Described

Continued Guidance Including Check-In Services Fundamentals Explained

When Professional Guidance Matters - An Overview

More

Latest Posts

9 Easy Facts About Exploring Debt Forgiveness in Uncertain Times Described

Continued Guidance Including Check-In Services Fundamentals Explained

When Professional Guidance Matters - An Overview